For Indian buyers, every tax change directly impacts the dream of owning a car or bike. The recent GST rate changes have brought good news — automobiles are now becoming cheaper across categories, from commuter bikes to mid-size SUVs. But why exactly is this happening, and what does it mean for consumers and the industry? Let’s dive in.

GST and Automobiles: A Quick Recap

Before GST was introduced in 2017, buyers had to pay multiple taxes:

- Excise duty

- VAT (varied state to state)

- Road tax, octroi, entry tax, etc.

This often pushed the effective tax rate above 40% on cars. GST simplified the system with uniform slabs. Now, with the latest revisions, several segments are taxed lower, leading to direct savings for customers.

Key GST Rate Changes

- Two-Wheelers (under 350cc): Slashed from 28% to 18%, making commuter bikes more affordable.

- Small Cars (under 4m length, <1200cc petrol / <1500cc diesel): Effective tax reduced by 2–4%.

- SUVs & Larger Cars: Still taxed at 28% + cess, but reclassification has helped some models avoid the “luxury” tag.

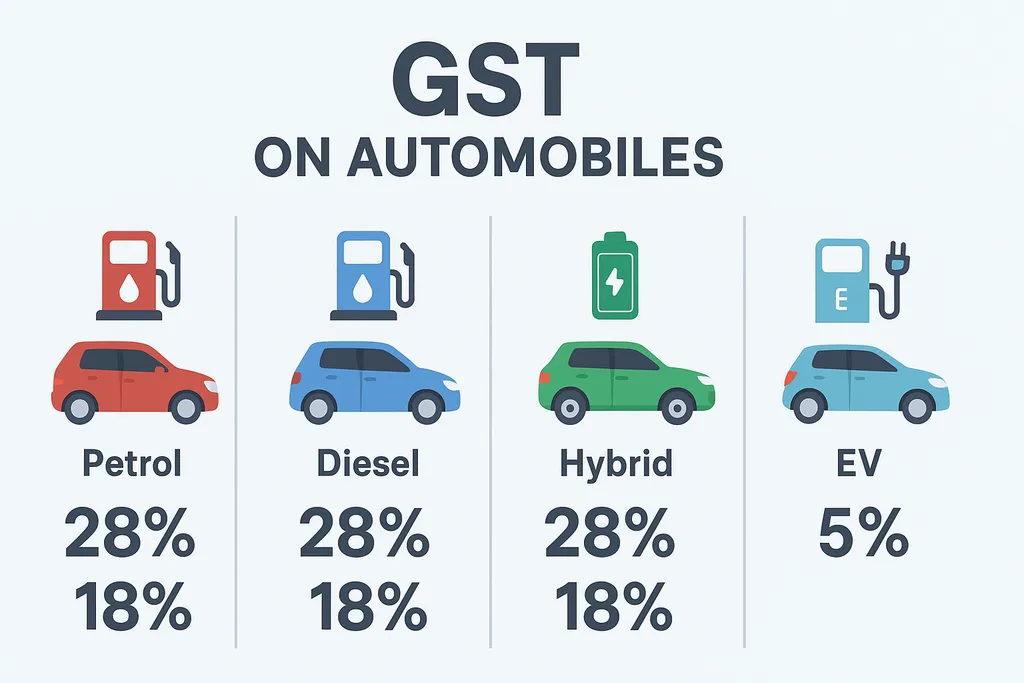

- Electric Vehicles (EVs): At just 5% GST, plus subsidies, EVs remain the biggest winners.

GST Rate Changes on Automobiles

- Petrol, LPG, or CNG motor vehicles up to 1200 cc and length up to 4000 mm: Earlier taxed at 28% + 1% cess, now reduced to 18%.

- Diesel motor vehicles up to 1500 cc and length up to 4000 mm: Earlier taxed at 28% + 3% cess, now reduced to 18%.

- Motor cars and other passenger motor vehicles (outside the above categories): Still taxed at around 40% (28% + 15–22% cess).

- Hybrid vehicles (spark-ignition + electric motor) up to 1200 cc and length up to 4000 mm: Earlier 28% + 1% cess, now 18%.

- Hybrid vehicles (spark-ignition + electric motor) over 1200 cc engine or length over 4000 mm: Still taxed at 40%.

- Hybrid vehicles (compression-ignition + electric motor) up to 1500 cc and length up to 4000 mm: Earlier 28% + 3% cess, now 18%.

- Hybrid vehicles (compression-ignition + electric motor) over 1500 cc engine or length over 4000 mm: Still taxed at 40%.

- All categories of electric motor vehicles (EVs): Remain at a very low 5% GST.

Price Comparison: Before vs After GST

The impact of the GST rate cut can be seen directly in vehicle prices. For example, the Honda Activa 125 used to cost around ₹86,000, but after the GST change, its price has dropped to about ₹79,000, saving buyers nearly ₹7,000.

In the small car segment, the Maruti Swift VXi was priced at around ₹7.20 lakh, but now comes in at about ₹6.95 lakh, giving a benefit of nearly ₹25,000.

Compact SUVs have also seen reductions — the Hyundai Creta E, which earlier carried a price tag of about ₹11.20 lakh, now costs closer to ₹10.90 lakh, saving customers around ₹30,000.

Why Are Automobiles Becoming Cheaper?

- Uniform Taxation: No more state-wise variation in VAT or entry taxes.

- Direct GST Cuts: Especially in the two-wheeler and hatchback categories.

- Reclassification of SUVs/MPVs: Some models moved out of the “luxury” bracket.

- Boost to EVs: 5% GST + incentives make them far cheaper than before.

Impact on Consumers

- Lower On-Road Prices: Reduced ex-showroom cost means lower road tax, insurance, and EMIs.

- Easier Financing: Banks now see stronger demand for affordable models.

- Wider Choices: Buyers can now consider higher trims or bigger models within the same budget.

Impact on Automakers

- Higher Sales Volumes: Especially in the price-sensitive two-wheeler segment.

- EV Push: With GST at 5%, companies like Tata, BYD, and MG are aggressively expanding their EV lineup.

- Competitive Pricing: Brands like Maruti, Hyundai, and Kia are launching better-equipped base variants to attract buyers.

Final Take

The GST rate changes are a game-changer for India’s auto industry. By reducing costs for buyers, the government has boosted demand while pushing manufacturers towards EVs and hybrids. For consumers, this means one thing — more car for your money.